Safeguarding Your Business: The Power of MDR and Cyber Insurance

In the fast-evolving landscape of technology, medium sized businesses and enterprises face an increasing array of cyber threats that can compromise sensitive data, disrupt operations, and damage the business’ reputation. To navigate this digital minefield, adopting a robust cybersecurity strategy is paramount. Two essential components of this strategy are Managed Detection and Response (MDR) and Cyber Insurance. In this article, we will explore the best ways to protect your business’s technology by integrating MDR and Cyber Insurance.

Understanding the Threat Landscape

Before delving into the protective measures, it’s crucial to comprehend the evolving nature of cyber threats. Cybercriminals employ sophisticated techniques such as ransomware, phishing, and zero-day exploits to exploit vulnerabilities in business networks. As technology advances, so do the strategies of malicious actors. This necessitates a proactive and dynamic approach to cybersecurity. It’s also critical to have a trusted technology partner to help guide the process.

Managed Detection and Response (MDR): Proactive Threat Management

MDR is a comprehensive cybersecurity solution designed to detect and respond to advanced threats. Unlike traditional security measures that focus solely on prevention, MDR combines advanced threat detection technologies with real-time incident response capabilities.

MDR employs continuous monitoring to scrutinize network activities and identify anomalies. By leveraging advanced analytics and machine learning, it can detect unusual patterns or behaviors that may indicate a potential threat. This proactive monitoring allows for the early identification of cyber threats before they can cause significant damage.

In addition to automated monitoring, MDR involves proactive threat hunting. Cybersecurity experts actively search for potential threats within the network, staying one step ahead of cybercriminals. This approach ensures that even the most sophisticated threats are identified and neutralized before they can wreak havoc.

Incident Response

MDR is not just about detection; it also includes a robust incident response mechanism. In the unfortunate event of a cyber attack, MDR enables quick and efficient response actions. This may involve isolating affected systems, removing malware, and restoring normal operations.

In the event of a cyber attack, MDR’s incident response capabilities can be complemented by the coverage provided by Cyber Insurance. This coordination ensures a swift and efficient response, minimizing downtime and financial losses. The collaboration between cybersecurity experts and insurance professionals enhances the overall resilience of the business.

Cyber Insurance: Mitigating Financial Risks

While MDR focuses on preventing and responding to cyber threats, Cyber Insurance acts as a safety net to mitigate the financial impact of a cybersecurity incident. Cyber Insurance policies are tailored to the unique risks businesses face in the digital realm.

In the aftermath of a cyber attack, businesses often incur significant financial losses. Cyber Insurance provides coverage for these losses, including expenses related to data breaches, system downtime, and the costs of recovering compromised data. This financial safety net ensures that the business can continue operating without facing severe financial setbacks.

Data breaches and cyber attacks can lead to legal ramifications, including lawsuits from affected parties. Cyber Insurance includes coverage for legal expenses, helping businesses navigate the complex legal landscape associated with cybersecurity incidents. This protection is crucial for maintaining the reputation and trust of the business.

The damage to a business’s reputation after a cyber attack can be long-lasting. Cyber Insurance often includes coverage for reputation management services, helping businesses restore trust with customers, partners, and stakeholders. This proactive approach to reputation management is essential for maintaining a positive brand image.

Integrating MDR and Cyber Insurance for Comprehensive Protection

While MDR and Cyber Insurance provide distinct layers of protection, their synergy is where their true power lies. Integrating these two components creates a comprehensive cybersecurity strategy that addresses both the technical and financial aspects of cyber risk.

The best approach is to engage a proactive threat detection system like MDR along with response capabilities. By identifying and neutralizing threats early on, MDR minimizes the potential financial impact of a cyber incident, aligning seamlessly with the risk mitigation provided by Cyber Insurance.

Continuous Improvement

MDR and Cyber Insurance both contribute to a culture of continuous improvement in cybersecurity. MDR evolves with the changing threat landscape, adapting its detection and response mechanisms. Simultaneously, Cyber Insurance policies are updated to address emerging risks. This synergy ensures that the business stays ahead of cyber threats and is well-prepared for any eventuality.

In the digital age, safeguarding your business’s technology is not a luxury but a necessity. MDR and Cyber Insurance offer a dynamic and comprehensive approach to cybersecurity, combining proactive threat detection with financial protection. By integrating these two components, businesses can create a resilient defense against the ever-evolving landscape of cyber threats. Investing in MDR and Cyber Insurance is not just a matter of protecting data and systems; it’s an investment in the longevity and reputation of the business in the digital era.

Free Guide to Protecting Your Business: Cyber Security & Cyber Insurance

Download this comprehensive guide and get answers to common questions about Cyber Security and Cyber Insurance.

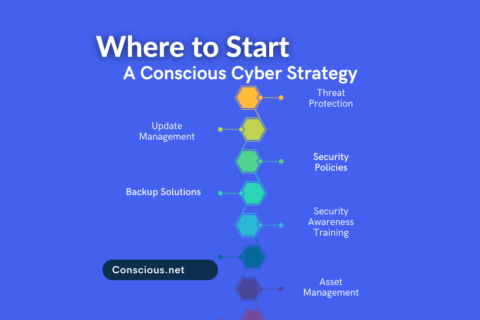

This guide reviews some of the basic cyber strategies that any business can incorporate. Most of all, this guide will help you understand how to get a free IT assessment for your business, implement best practices, and balance budget vs. risk. The guide will also help you understand the 7 key purposes of cyber insurance and how to determine your coverages and obtain potential discounts.